4Q2022 Scouting Report-Written Version

For those of you who prefer to read, as opposed to watching videos, this report is for you. However, as I always say when writing these “nerdier notes,” I challenge you to stick with me instead of clicking the button and deleting this email, just as I challenge myself to write these reports in a manner that most people can understand the information provided, should they choose to do so!

Before I start, I also want you to know that I cut out roughly 30% of the content that exists in the Quarterly Scouting Report video. So, if you’d like more information on the economy, inflation, automotive sales, mortgage rates, and real estate, head over to YouTube and give it a gander.

Alright – let’s get into it…

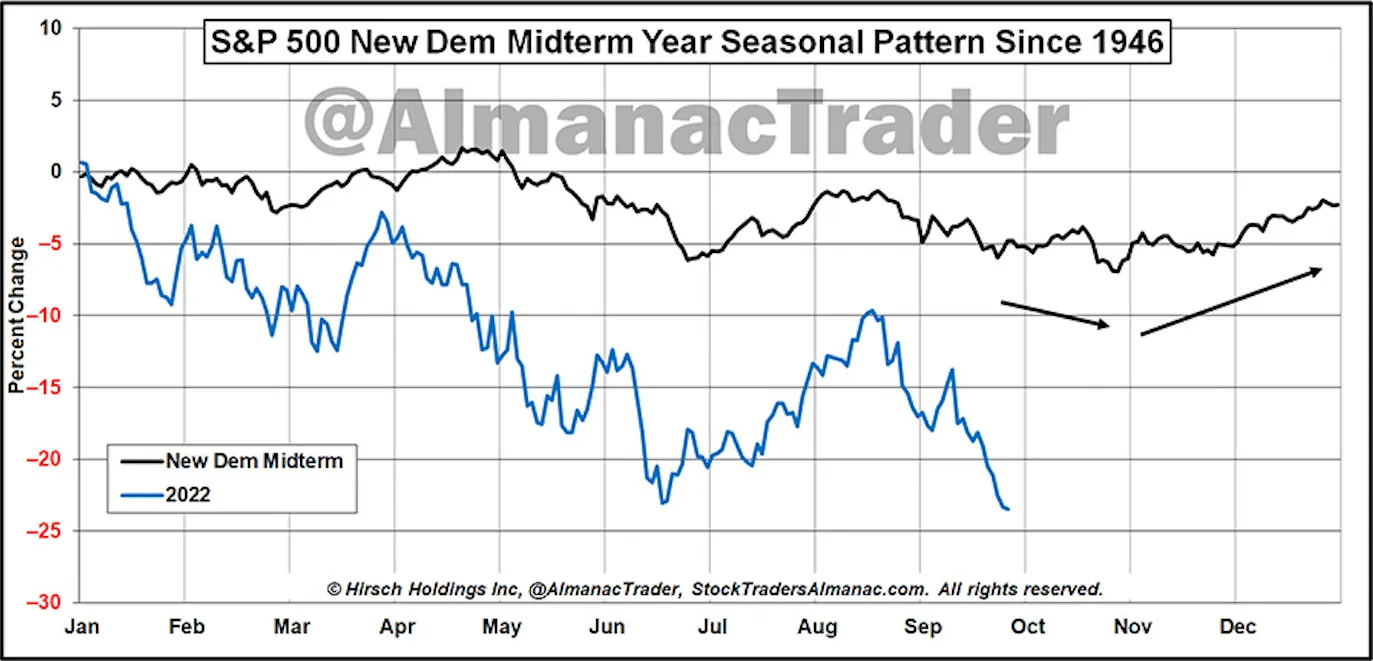

My first picture below is the S&P500 this year, as of the beginning of October, down more than -25%.

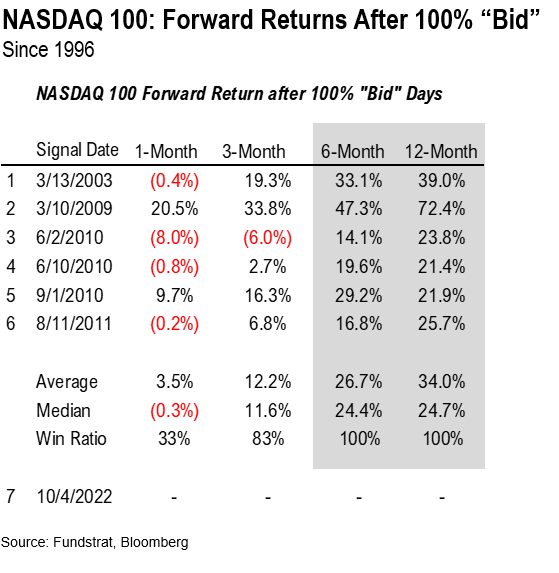

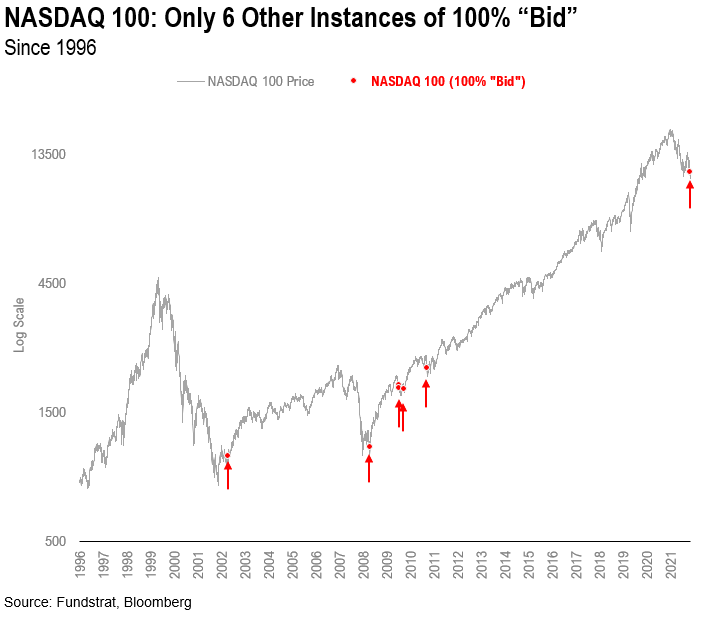

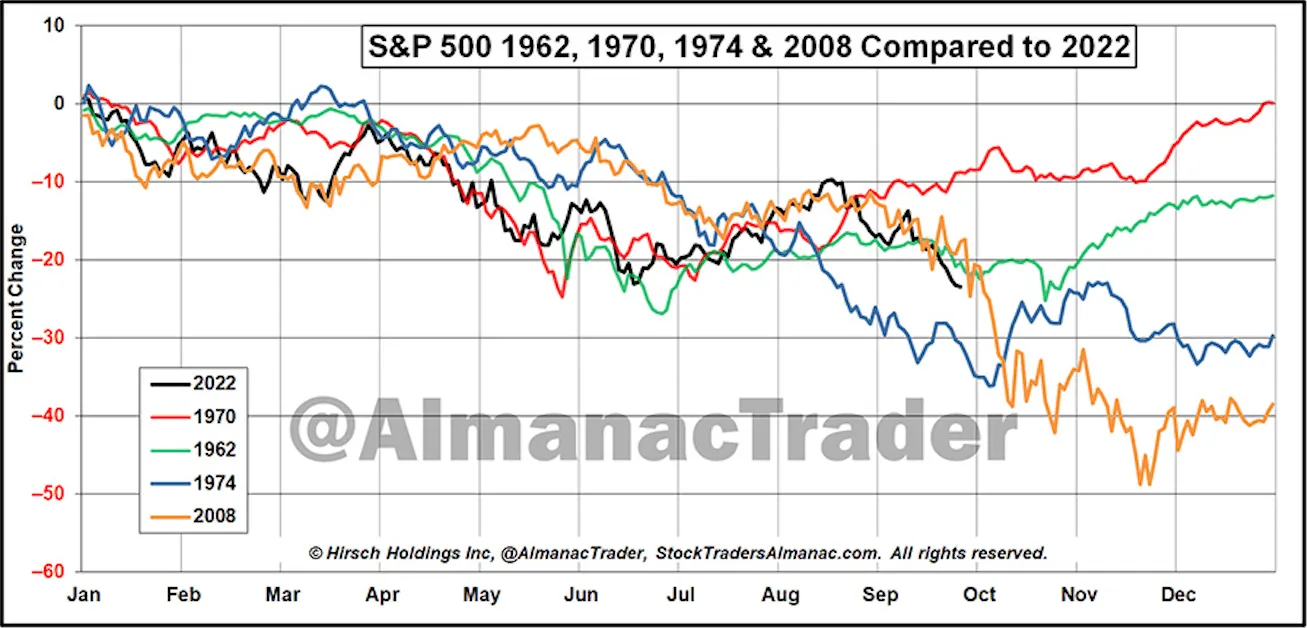

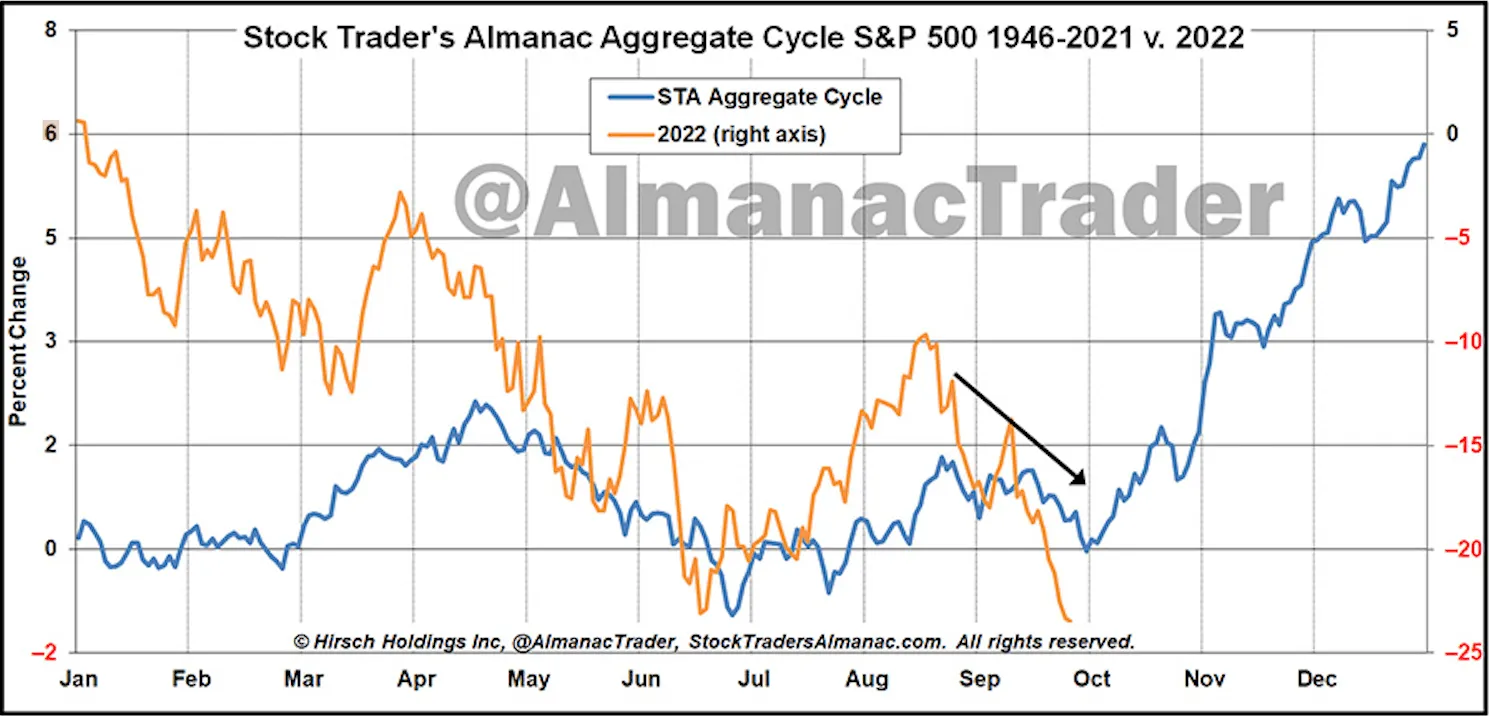

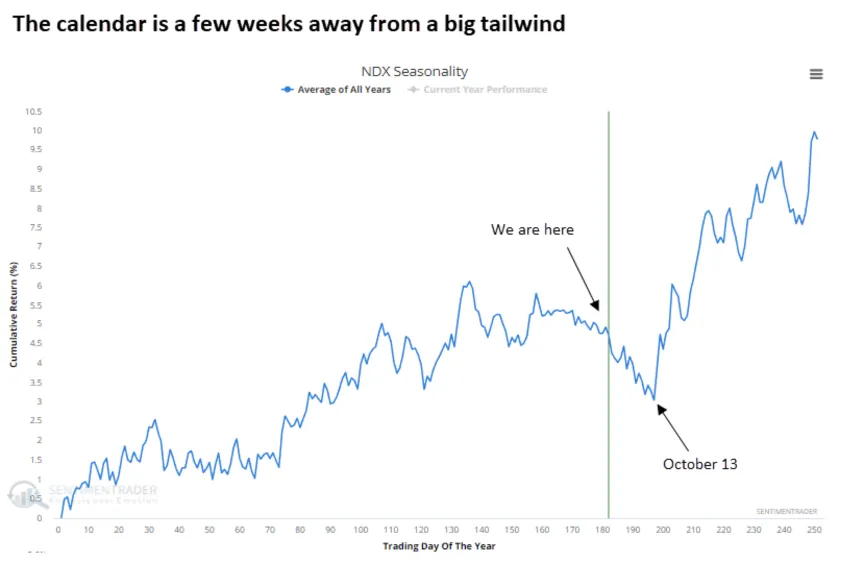

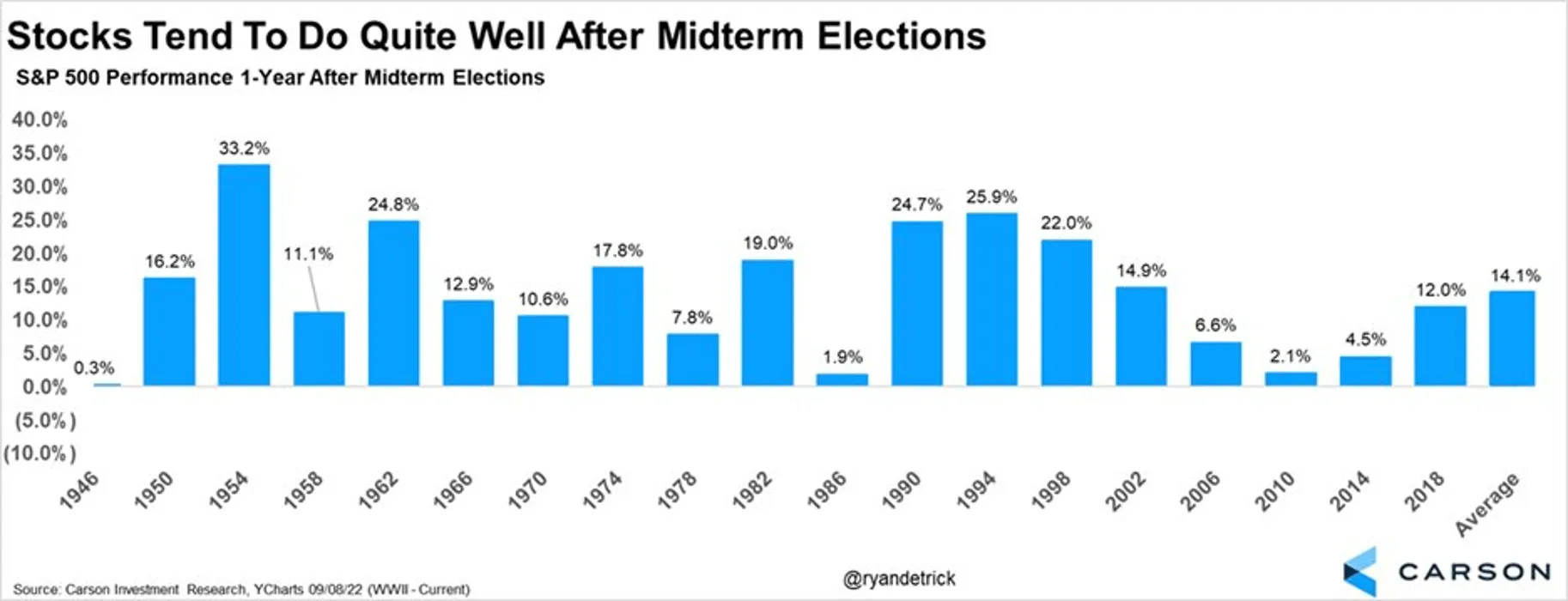

…and this is the raw data that not

Does this mean that the market HAS to go up next year? Of course not. Depending on your emotional predisposition (combined with how much financial and political news you subject yourself to), you might believe that 2023 is surely going to be the first year it’s down!

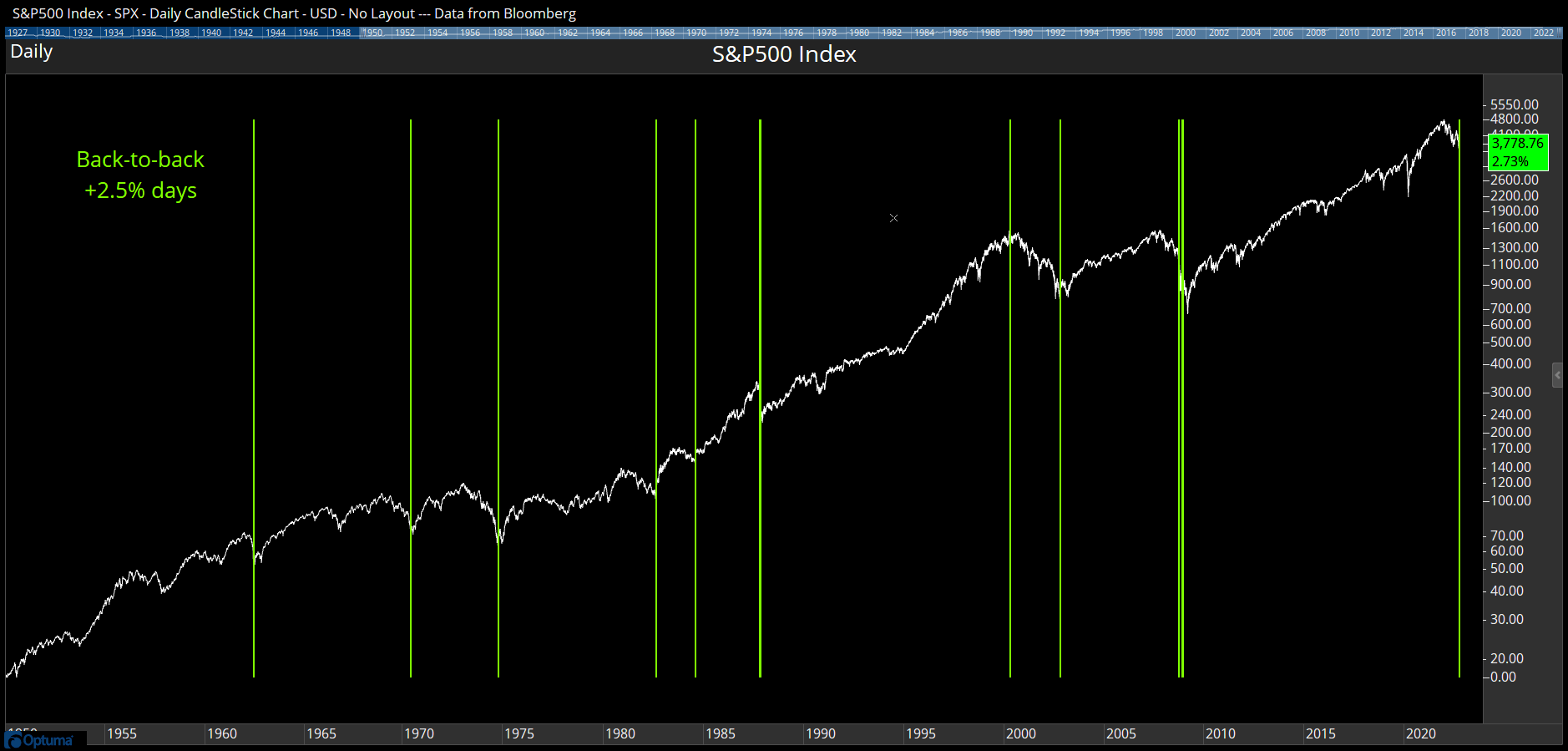

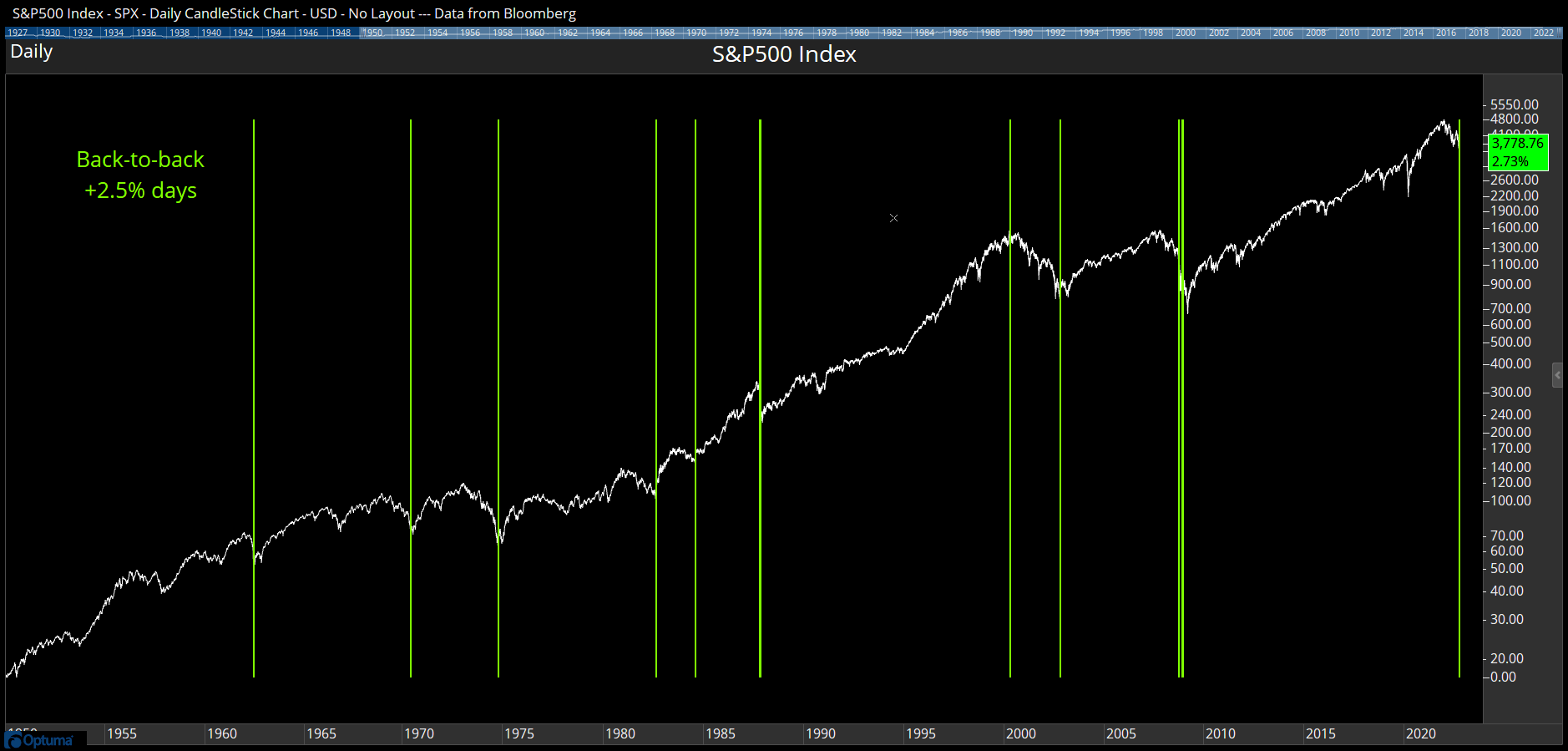

Well… I’m not trying to convince you that it’s going to be up OR down. I’m just showing you what I’m looking at on a day-to-day basis, and from there, I re-allocate our portfolios in a way that coincides with the weight of the evidence. In other words, all these charts are just that – “evidence.”

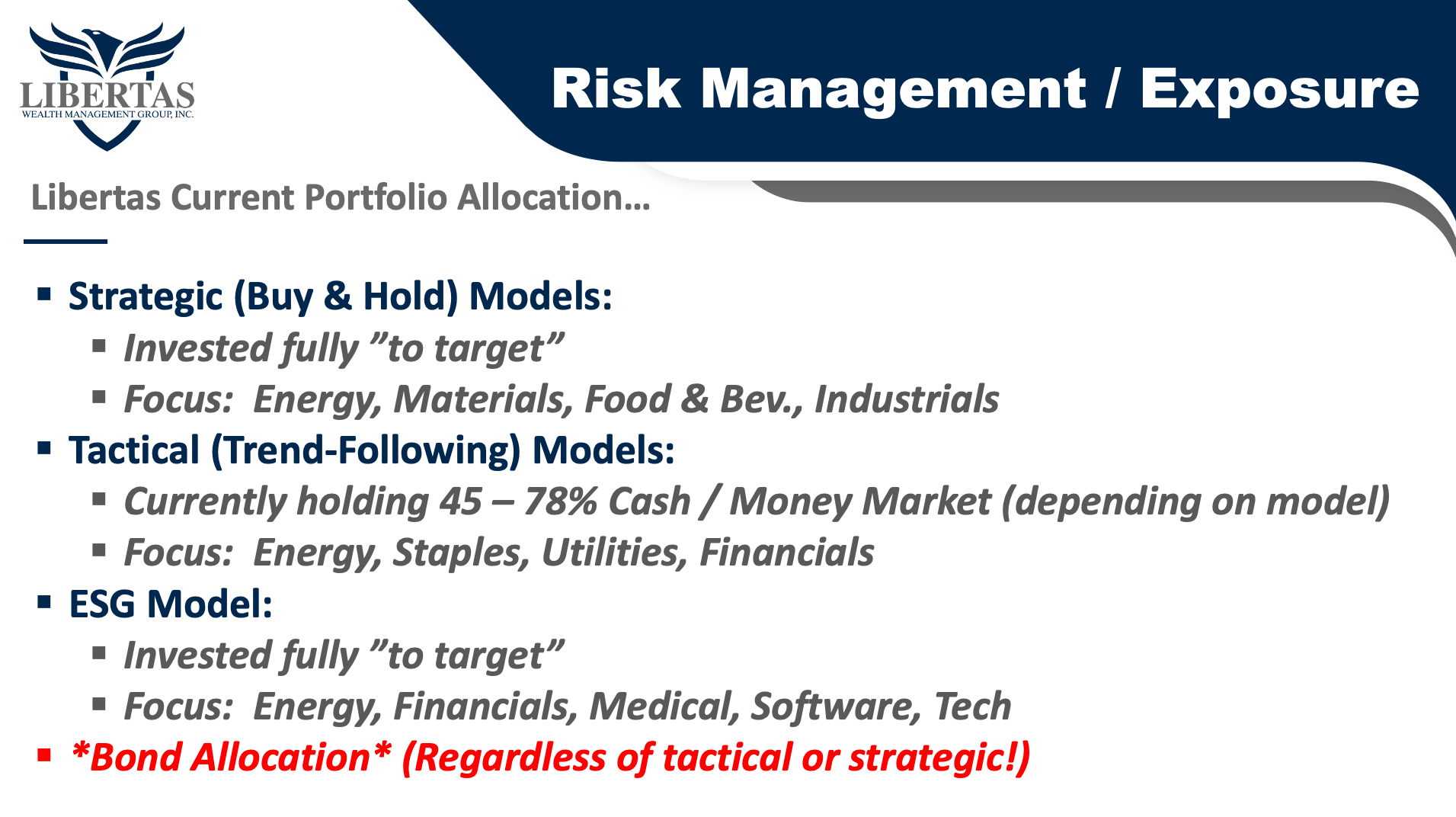

Currently, our Strategic (static / buy & hold) models are all invested “to target,” meaning they’re 100% invested in what we like to call “the playoff teams,” all while avoiding the rest of the investments that are lagging. Said another way, we’re investing in the investments that have the highest relative strength vs. the market vs. all sectors, and of course, their peers.

Our Tactical (Trend Following) models are also invested in the highest-RS (relative strength) “playoff teams,” but each individual investment also has its own “extra layer” of protection. When trends on any individual investment break down (based on our proprietary trend-following strategies), we simply sell the investment and move the proceeds to cash/money market.

So, while our Strategic models are 100% invested in the “risk model” in question (i.e., aggressive, moderate, balanced, vs. conservative) our trend-following models have held anywhere between 45-78% cash/money market (selling started in February), all depending on how aggressive or conservative the model.

Which strategy or model makes the most sense for you?! Well, if you’re a client we’ve already completed THE most important item in your “Financial House.” Your full-blown, comprehensive Financial Plan, which is required before we invest a dime of anyone’s hard-earned savings…

…and the plan tells us how much risk we should take, all while the education we provide + our private discussions help us align your personal situation with which (or in most cases, a combination of) strategies make the most sense for you and your family.

We also manage a “Socially Responsible” ESG model for those who have interest in avoiding certain investments and/or sectors in the market that might not align with your personal values.

If interested in an introduction call, please contact us to set one up, and I can share more details with you.

Meanwhile, below is the corresponding slide (including our current sector focuses) from the Quarterly Scouting Report Video, which you can refer to HERE.

Now, as always, go spend time with your spouse, partner, kids, or parents – enjoy the nice, crisp fall weather and a fire pit, pick up a good book, watch a movie or intriguing documentary, and instead of worrying about this stuff, let us stress about it for you. J

Till next time…

Adam