April 2024 Monthly Market Brief

Not much has changed in the market this past month, other than the fact that it continues to go higher, despite much of the negative rhetoric from perma-bears in financial media and online.

That being said, the longer the market goes up this escalator, the higher the probability we see an “elevator down” – at least for a period of time.

Here’s a quick update, as always, of our “Inverse Traffic Light” of the S&P500:

- The market broke out above the 2021 highs, we saw a very small pullback, and it’s just headed higher ever since,

- We’re very solidly in the “green zone,” with those same 2021 highs and the breakout point being the “floor” of potential support, below which we’d be back into a “caution” zone,

- A drop to the “caution” zone would represent a decline of roughly -8%, which isn’t even representative of a typical, annual market correction (which is normally a drop of -14%)

As I’ve mentioned before, the market can “correct” in two ways:

- Through price (correcting downward), or

- Through time (correcting sideways)

Naturally, I continue to root for the latter, as some sideways digestion of these gains would be a whole lot more fun than a stereotypical run-of-the-mill drop in the market.

Unfortunately, the market doesn’t care what I think or what team I’m rooting for, which is why – in using technical analysis – we always say that we’re not trend predictors, but trend followers.

No one can predict what the market is going to do tomorrow, next week, next month and so on… but we can react to changing market conditions to metaphorically stack the deck in our favor.

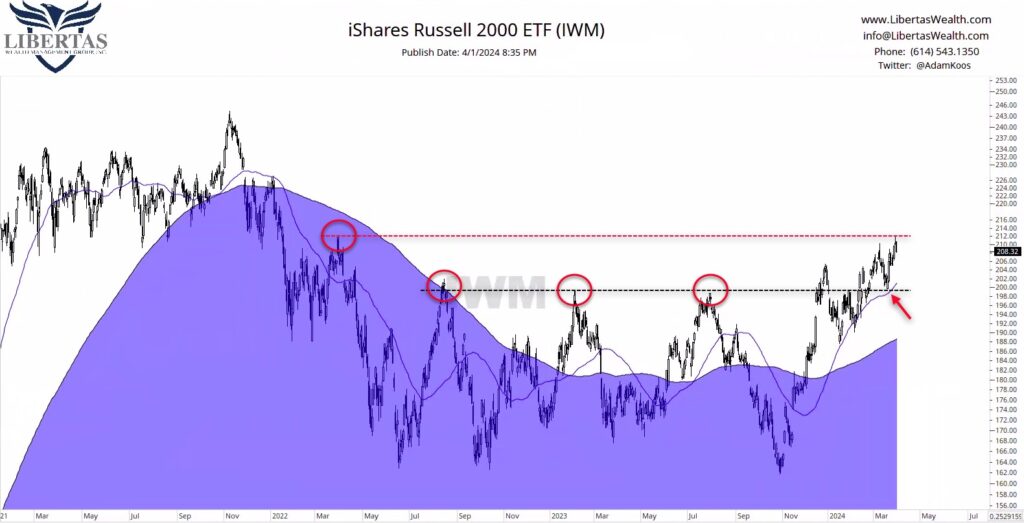

We continue to closely watch the Russell 2000, which represents small-cap stocks, as they’ve started to exhibit more strength over this past month (full disclosure: we’re long small-caps in almost all of our portfolio models with a few owning a 2X leveraged position at the current time).

As you can see below (last arrow on the right), small-caps retested a floor of support that was formerly a ceiling of resistance and then headed higher. Now, these small company stocks are up against a ceiling of potential resistance that goes back to early 2022, where some sellers might reside – and as sellers get out of the investment, this puts downside pressure on the investment – which is why these lines-in-the-sand exist.

I’m a couple days late getting this “brief” report out (I like to send them on the 1st of the month), but so far this week, the market as a whole has been pulling back, taking small (and mid) caps right along with it.

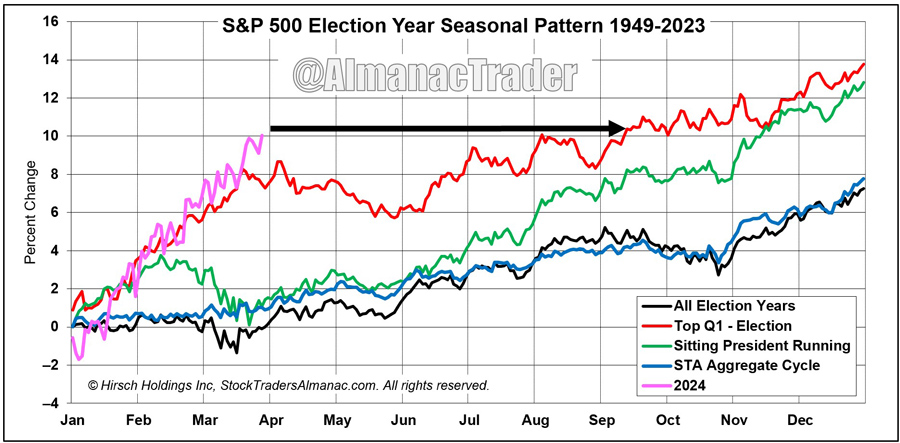

Speaking of pullbacks… and revisiting the comment about our perma-bear friends in my opening statements, while the market has done extremely well this year thus far, you can see below that, in past years that have looked similar, the next two months have been historically weak, and when you go out five months into the future, you can see that the average market price remains roughly where it is today.

Does this mean the market has to go down? No.

Does it mean it’s going to correct sideways and go absolutely nowhere for five months? No.

Information like this gives us evidence to weigh against other evidence to determine how to react to the markets and position ourselves in an allocation that makes sense, based on the overall weight-of-the-evidence.

Right now, we’re in the green zone, even mid and small-size companies are starting to participate in the uptrends we’ve been seeing in the large and mega-cap space, and the market is defying negative seasonality … like in March, when markets typically go down in election years – and this March didn’t. That is good information and evidence that we’re living in a very strong market.

When you boil it all down to the utmost simplicity, the stock, bond, and commodities markets are merely a constant, daily battle of buyers battling sellers, and what we do is try to identify trends and strength over time, within these battles.

From there, as markets get long-in-the-tooth, we look for evidence to pile – enough evidence to where Newton’s Law starts to rear its head:

“An object in motion remains in motion unless acted on by an unequal, opposing force.”

…and then we react, adjust, and adapt to changing market conditions.