Cinderella Stories: How March Madness and NCAA Seeds Predict Investment Wins

What’s All This “Madness” about, anyway?!

Every March, basketball fans get excited for the NCAA tournament, also known as March Madness, where 64 college teams compete in a single-elimination battle to be crowned champions.

The excitement isn’t just about the games themselves but also about the office pools and bracket challenges, where fans guess the winners of all the games. It’s tough to predict a perfect bracket (with odds ranging from one-in-128 billion to one-in-9.2 quintillion), but the NCAA tries to help by seeding (i.e. ranking) the teams, making it a bit easier for fans to make educated guesses.

The Process of “Seeding” Teams

Seeding, which started in 1979, ensures the best teams don’t meet too early, keeping the tournament interesting and fair. After all, no one wants to see a complete blowout in the finals…

It also helps fans, even those not deeply familiar with all the teams, have a starting point for their predictions. Historically, top-seeded teams have performed well, often making it far into the tournament, but there have been notable exceptions where underdogs have triumphed, creating exciting “Cinderella” stories.

Data shows that higher-seeded teams usually win, especially in the early rounds, but the tournament is known for its surprises, like when a number 16 seed beats a number one seed, which has happened… but it’s super-rare.

Despite the odds, fans love to predict these upsets, even though top seeds generally have a strong track record of advancing.

Humans Invest Their Money Like They Pick Their Brackets

This tournament excitement is similar to how investors look at stocks. Much of the movement in a stock’s price is related to its sector and the overall market, not just the company itself. Yet, investors often focus on individual companies.

In the same way, NCAA fans might obsess over the potential of lower-seeded teams to win, despite the higher likelihood of top-seeded teams succeeding at the end of the day.

Until Recently, No 1st Seeded Team had EVER Lost in the First Round!

Before 2018, no top-seeded team had ever been beaten by a 16th seed in the tournament’s history. However, in that groundbreaking year, the University of Virginia Cavaliers became the first ever top seed to lose in such a fashion to a score of 74 to 54 to the University of Maryland, Baltimore County Retrievers in the opening round.

This record of UMBC as the sole 16th seed to advance past the first round held until the 2023 tournament, when the Fairleigh Dickinson University Knights managed to upset their number one seed opponent, Purdue, by a score of 63 to 58. Despite their victory, FDU (much like UMBC before them) was eliminated in the very next round by the ninth-seeded Florida Atlantic.

So with that all behind us, let’s take a look at the TRUTH behind picking your teams in the March Madness bracket, and then learn how similar it is to picking the investments in your retirement portfolio…

You’ve heard it before – “Past performance is not indicative of future results” – and this is the case both in picking your brackets or choosing the investments in your portfolio. However, focusing on the higher-ranked (or as I like to call it when using other sports as an analogy picking “the playoff”) teams is a whole lot better starting point than trying to guess which laggards are going to be this year’s improbable Cinderella investment.

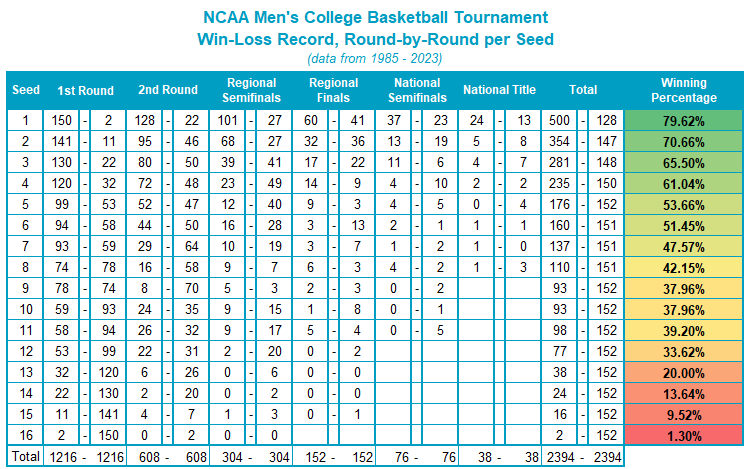

The table above might be a little confusing, but here’s a brief summary of the main points, just to boil it down to the important stuff…

NCAA Tournament Seeding Insights (1985-2023):

NCAA Tournament Seeding Insights (19885-2023):

- Teams seeded first have secured the highest win rate, achieving victories in 80% of their games.

- The top three seeds boast a remarkable performance, with 1135 wins against 423 losses, translating to a win rate of nearly 73%.

- In contrast, the teams seeded 14th to 16th have only managed to win 42 games, which represents a little over 8% of their matches over 38 years.

- The five highest-seeded teams have a combined winning percentage of 68%, whereas the five lowest-seeded teams have secured victories in only 17% of their games.

- Interestingly, number one seeds have accumulated more wins (500) than the total number of games played by the three lowest-seeded teams (498).

- Over the span of 38 years, teams among the top three seeds have clinched the national championship 33 times.

- The year 2021 was notable as it marked only the second instance of a 12th seed reaching the Elite Eight; moreover, no team seeded 12 or lower has ever made it to the Final Four, and no team seeded lower than eighth has reached the NCAA championship game.

Pick Your Investments Like You (Should) Pick Your Brackets

In the world of investing, using relative strength to “seed” investments is akin to how NCAA teams are ranked based on their performance. Investments representing the highest relative strength are considered higher seeds, indicating stronger performance trends. This method mirrors the NCAA’s approach, where teams are seeded based on their recent and head-to-head performances.

Historical trends suggest that just as top-seeded teams are more likely to succeed in the tournament, investments with high relative strength are generally more reliable and offer better chances of success compared to their lower-ranked counterparts… and although there’s always room for upsets, in both sports and investing, the smart strategy leans towards backing those with a proven track record of success, rather than betting on the unpredictable Cinderella stories.

Click Here for a really old podcast (and screencast) episode we did on this very topic, in case you want to soak up more educational info – and if you’d like to consider a potential 2nd opinion on your retirement plan, estate plan, and investment portfolio, CLICK HERE to take the first steps to answer a few questions and get an intro call set up on our calendar.

‘till next time!

Adam

Adam Koós, CFP®, CMT, CFTe, CEPA is a CERTIFIED FINANCIAL PLANNERTM, one of only 1,754 active Chartered Market Technicians (CMT) worldwide, as well as a Certified Financial Technician (CFTe®) through the International Federation of Technical Analysts (IFTA), a Certified Exit Planning Advisor (CEPA) through the Exit Planning Institute. He’s been named by Columbus Business First as one of their 20 People to Know in Finance, is a recipient of the Forty Under 40 award, is ranked by Investopedia as one of the Top-100 Most Influential Financial Advisers in the U.S., and is the winner of the coveted Better Business Bureau Torch Award for Ethics and Trust. Adam serves his clients as the president, portfolio manager, and senior financial adviser at Libertas Wealth Management Group, Inc., a Fee-Only, NAPFA-registered Fiduciary and Registered Investment Advisory (RIA) firm, located in Columbus, Ohio.