Magazines that Predict the Market!

If you missed the related podcast on this topic, CLICK HERE and you’ll be taken to the YouTube video “vlogcast.”

However, if you’re more of a reader than a watcher, you’ll only miss out on hearing me struggle not to laugh at some of the ridiculous magazine covers and corresponding charts that just make you go “hmmmm….”

The point of the podcast – and this article – is that magazines in the finance and business world have an uncanny ability to be wrong.

We’re not talking about a little wrong. In some cases, these “predictions” are DEAD wrong!

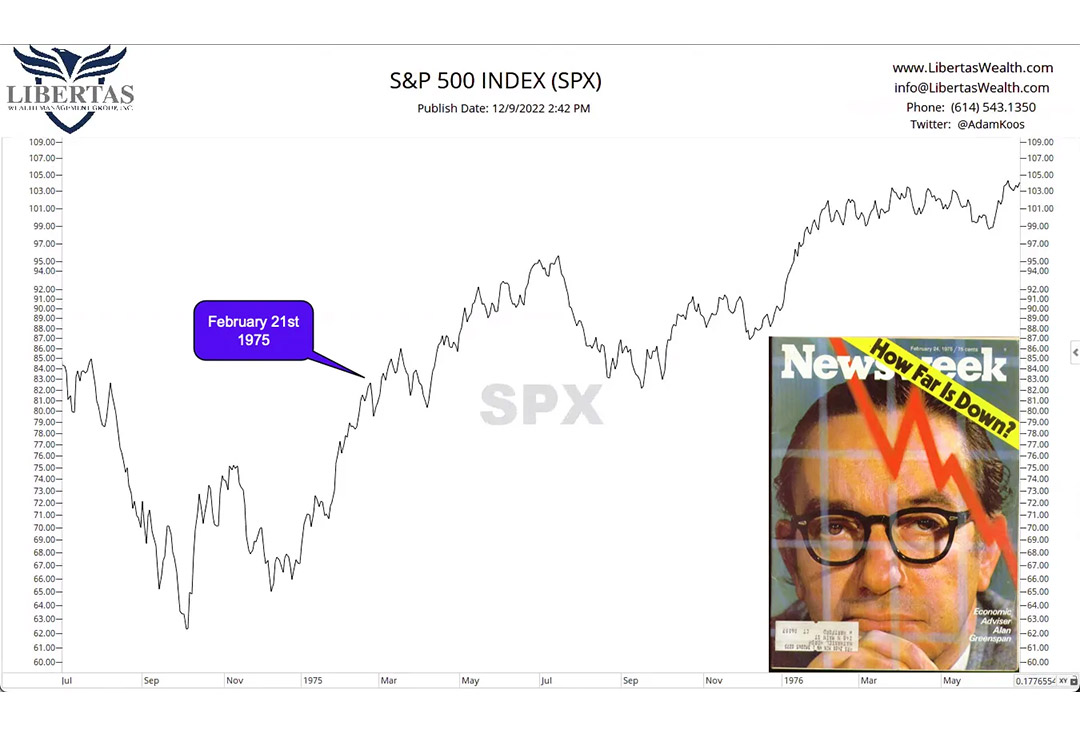

Let’s start with Newsweek on February 21st of 1975 – a time when investors were dealing with a stock market crash, high volatility in the markets, and runaway inflation. Sound familiar?

The cover of Newsweek came out and read “How far is down?”

In reality? The market had already started a strong rebound, which continued into 1975, pulled back in summer, and then headed to new heights in 1976.

Again – sound familiar? Remember that famous Mark Twain quote:

“History doesn’t repeat itself, but it sure does rhyme.”

After this magazine cover hit newsstands, the market rallied, pulled back and tested the May lows, rallied again to higher-highs, pulled back a 2nd time to test both the October and May lows, only to ultimately break out to new, all-time-highs by summer of 1980.

Might I add “…in spite of high inflation and the highest interest rates this country has ever seen.”

The S&P500 was up as much as 32% just 16 months later, but I digress…

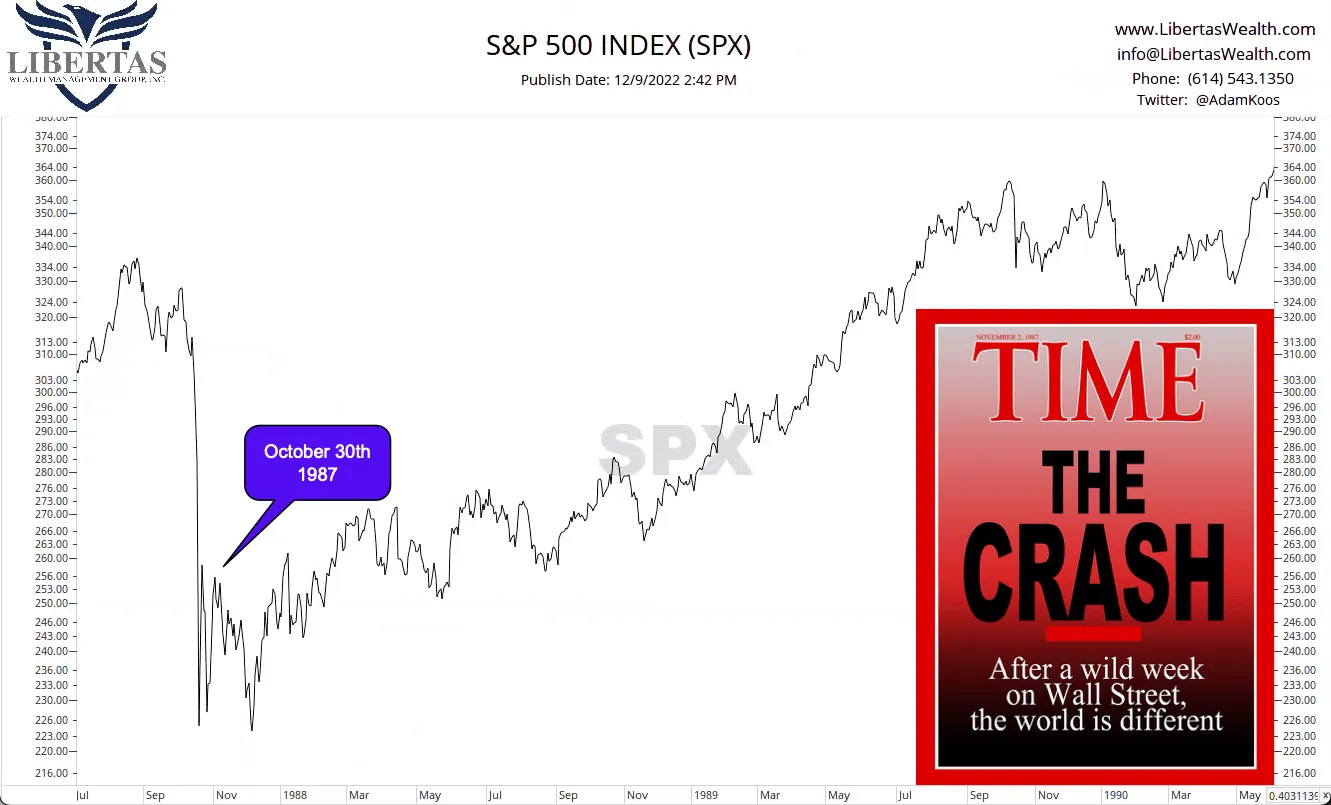

Our next cover is brought to you by our friends at Time Magazine…

On October 30th of 1987, just days after Black Monday (when the stock market dropped -22% in a single day), they ran the cover below, which read “The Crash – After a wild week on Wall Street, the world is different.”

Was it that different?

Well… not so much. Instead, the market pulled back and retested the October lows just once before heading to new all-time-highs. Just 2 years later, the S&P500 was up more than 40%.

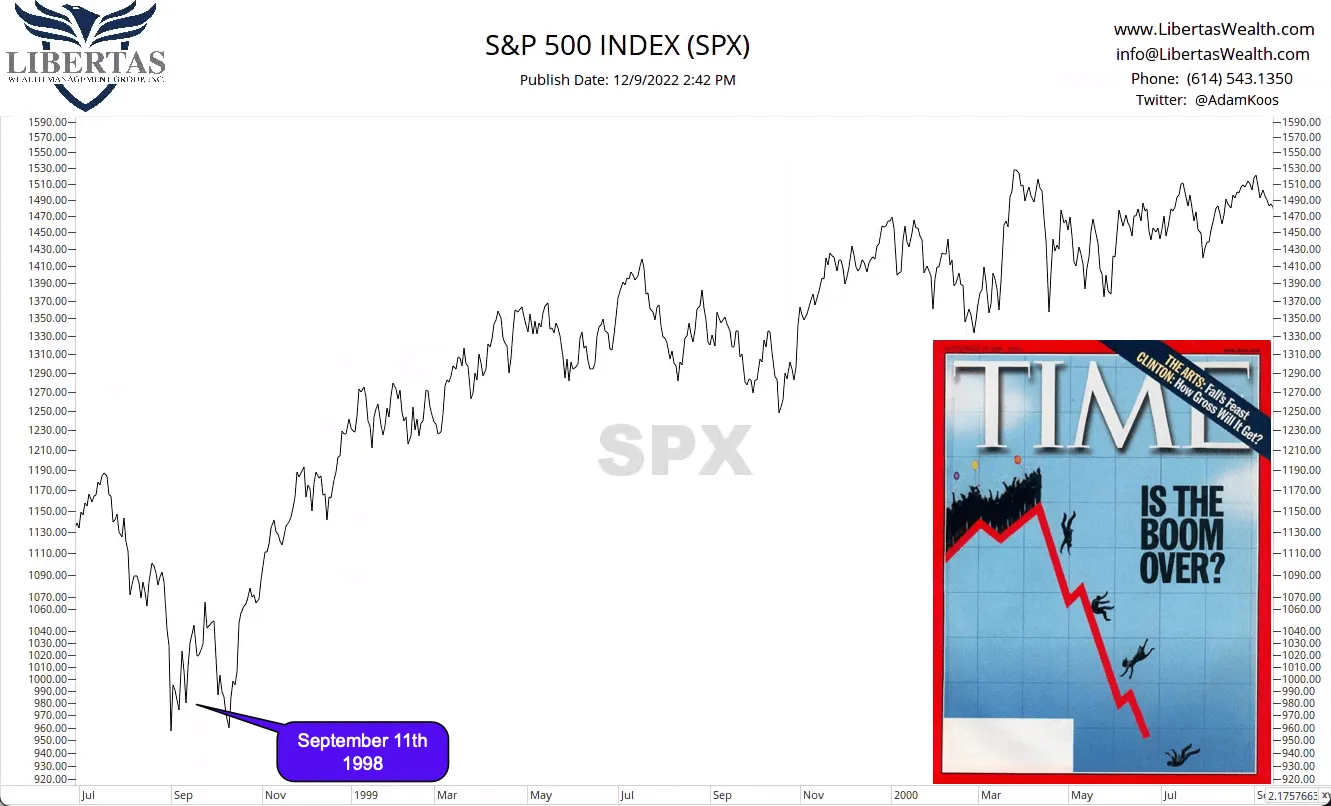

Here’s another one from Time Magazine, right in the midst of the strongest bull market our country has ever seen. On September 11th of 1998, Time ran the cover, “Is the Boom Over?”

Just look at the picture – this is one I found really funny. A chart heading downward with people falling, head-over-heels?! Talk about fear mongering!

What really happened?

Again, the market pulled back, retested the lows, and instead of “the boom being over,” the S&P500 was:

- Up more than 34% a year later, and

- Up 55% by the peak of the dot-com bubble

Get this one – just one year after the magazine cover above, below we have Time coming out with a new prognosis for the future, but this time, they’ve completely flip-flopped from their reporting at the bottom of the market in 1998!

This time, the cover runs on September 24th, 1999 – just six months before the peak of the dot-com bubble, after which the market fell -47% over the course of the 24 months that followed.

“Get Rich.com?” Hmmm…

Again, we’ve got Time Magazine below… and they run this cover almost two years after the one we just observed above, and what does it read?

“Will You EVER Be Able to Retire?”

…and they ran this cover just eight months before the bottom hit, but more importantly, someone decided to run it 18 months after the market peaked! Would you think we’d be closer to a bottom than a top at that juncture?!

Still, the stock market ended up closing positive, to the tune of +18% one year after the magazine cover ran… up almost +30% two years later.

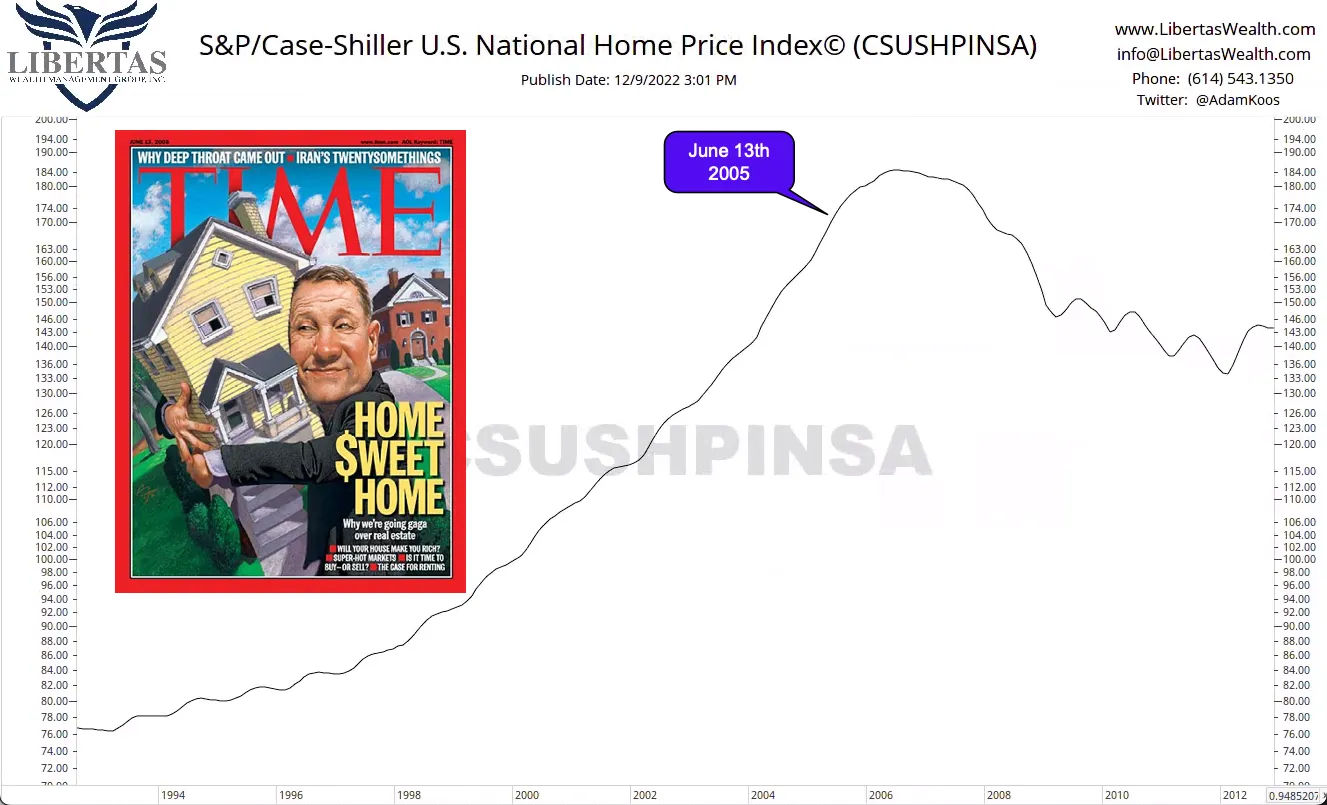

Here’s a cover, below, that I think they’ll forever regret publishing.

Instead of the stock market, this is a chart of home prices in the U.S. compared to when Time ran the cover titled “Home Sweet Home – We’re Going Gaga for Real Estate.”

It even included bullet points on the cover that read, “Will real estate make you rich?” and “Super-Hot Markets.”

Notice, of course, the timing of this magazine cover – just months prior to the inception of the mortgage crisis and subsequent peak of the real estate market.

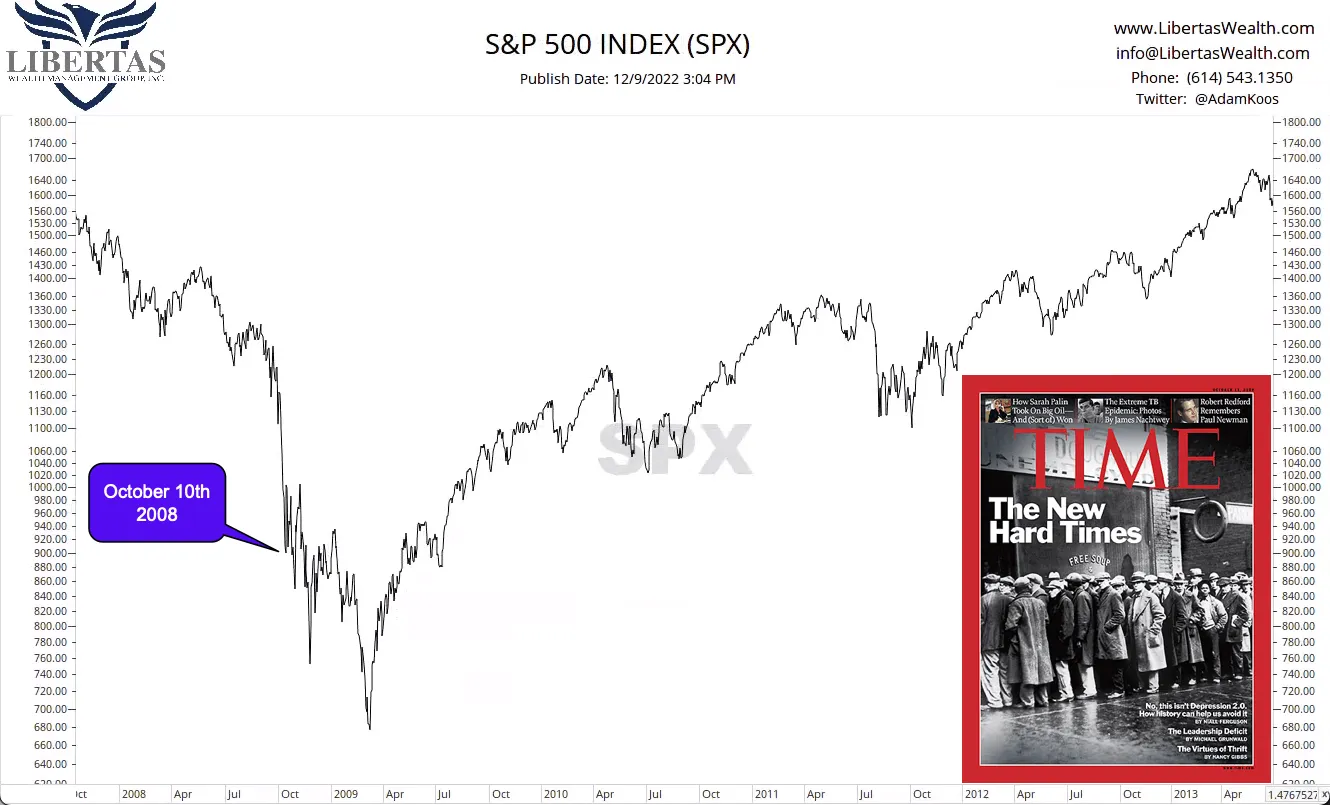

Here’s yet another Time Magazine cover, which ran on October 10th of 2008, less than five months before the ultimate bottom of the mortgage crisis and corresponding stock market crash (when the market fell almost -57% in 18 months).

The cover reads “The New Hard Times,” and as you can see, the stock market proceeded to head higher (eventually to all-time-highs) over the course of the five years following this publication.

I’m sure that you’re starting to get the hang of this strange phenomenon, but you just can’t make this stuff up!

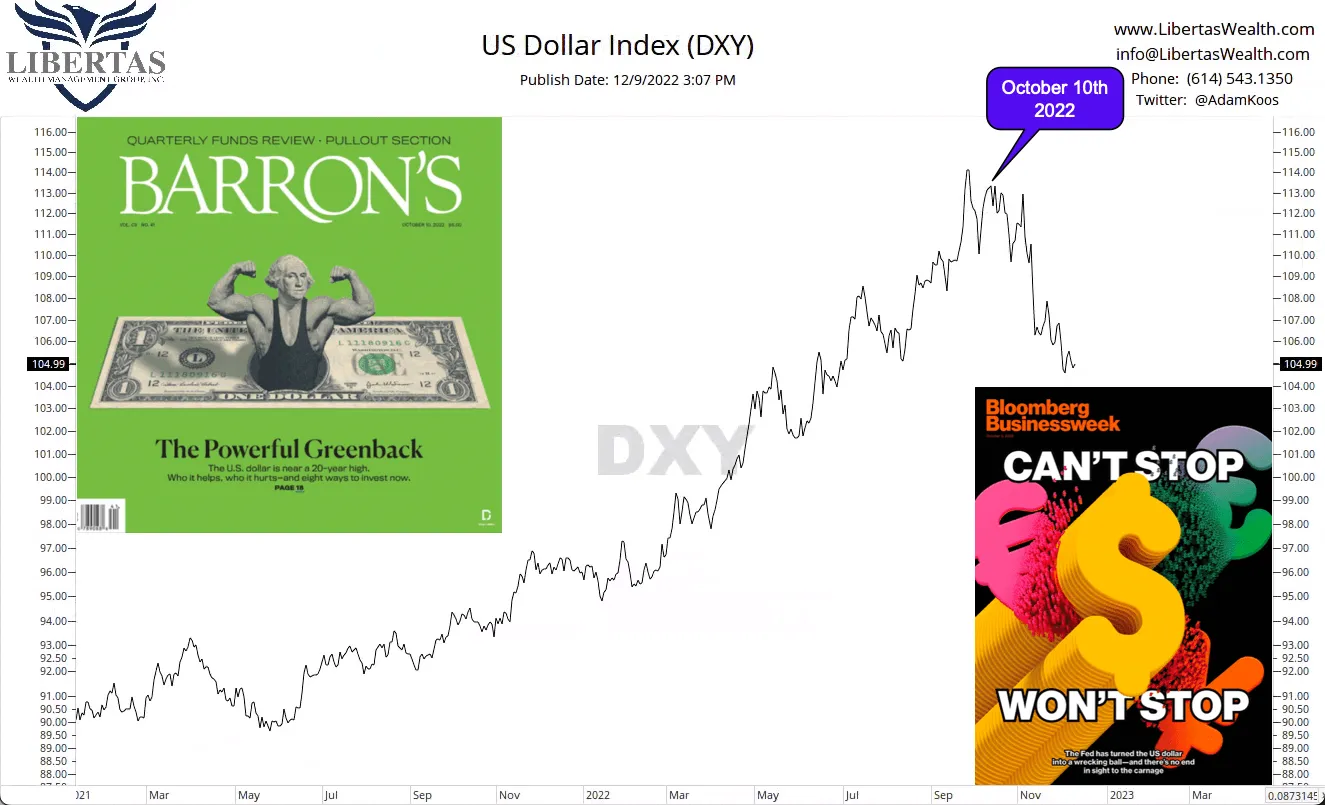

Here are two magazine covers – both ran just a few months ago, this year.

First, you have Barron’s with the cover of George Washington appearing as if he’s a body builder or wrestler maybe? He’s emerging from the center of the one-dollar-bill, with the cover text that reads “The Powerful Greenback.”

Then, you have Bloomberg Businessweek, right around the same time, comes out with an old-school, disco-looking cover with the US Dollar sign emerging, reading “Can’t Stop – Won’t Stop.”

It’s early, but look at when these magazines ran… and notice how the US Dollar has fallen in value since then.

I just did the math (because this is what I do for fun), and as of right now (6:55am, prior to the market open on December 22nd, 2022), the Dollar has been down as much as -8% since then (currently down around -7.6% or so).

Below is another new cover – this time from InvestmentNews, which is a trade magazine for financial professionals. Of course, it reads “Keep Calm and Retire Later.”

Is this advice worth taking? Maybe… I guess it depends on your situation, right?

In fairness, the fine-print (which is clearly a huge contrast to the “catchy” cover) highlights that the tagline is advertising an article in the magazine that focuses on when to take social security income, but still.

Did you focus more on the fine print, or the big, bold, white headline?

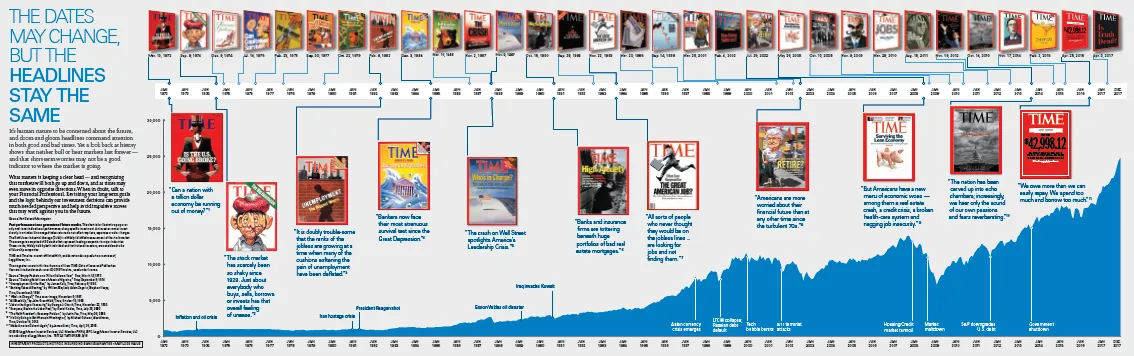

Below is an image that’s really hard to see on this page, but it’s an older one we found a while back, and it does a good job of pointing out all the times magazine covers steered investors in the wrong direction.

Reply to this email and reach out to us if you’d like the larger version and someone on my team will send you the PDF.

…and consistently analyzing the markets, price movement, momentum, and volume – the decisions that market participants make as an aggregate of the entire market – this is the analysis of human behavioral psychology!

Continually scanning the investment landscape for relative strength, staying invested in the winners (or said another way, staying invested in “the playoff teams,” as I like to put it) while avoiding the rest. Learning how to think long-term while staying nimble in the intermediate term, all while knowing that there is no strategy that will work ALL the time.

However, if you build the right strategy – one that’s customized for YOU – with patience, discipline, and perhaps a fiduciary guide by your side? …it will work over time.

So, whether you’d like a 2nd opinion on your retirement plan and investment portfolio as part of your “New Year’s Resolution,” or you don’t have a plan, but you feel like you’re overdue – please feel free to reach out to us and set up an introduction call.