Wills and Trusts

The foundations of your rock-solid estate plan!

For so many of us, family is paramount. You probably expect to use your wealth to take care of your family in the here and now (health care, travel, college tuition and the like).

Chances are, however, you haven’t thought nearly as much about positioning your assets so they’re ready and able to help the people you love after you’re gone.

Even if you’ve made some headway in this area, your plan for your estate is probably a little (and maybe a lot?) out of date. In fact, this is the number two most procrastinated financial planning item – second only to business owners and CEOs not having an exit plan.

The good news? Even if you have many moving parts to your finances, you can get on track by focusing on two main areas of estate planning:

- Wills

- Trusts

And here’s how to do it…

“Where there’s a will, there’s a way.”

Read this next sentence three times in a row: Everyone should have a will.

No, not once… two more times. Ready?

Everyone should have a will.

Everyone should have a will.

There you go… got it?

A will should be the basic foundation of every estate plan, as it serves as the starting point for a well-conceived strategy to transfer assets at death.

A will identifies precisely what you want to have happen to your assets and estate. Dying without a will means you have decided that the state knows what’s best for you and your family! It’s called “dying intestate.”

In addition, dying without a will means you want to make the settling of your estate as difficult, as costly, and as public as possible.

Does this sound like you? I didn’t think so…

As with any decision, there are both positives and negatives to a will. That said, we strongly believe the benefits of writing a will far outweigh the drawbacks.

Pros:

- You decide on the disposition of your hard-earned wealth.

- Estate taxes are mitigated—especially when the will is part of a broader estate plan.

- You specify who the fiduciaries will be.

Cons:

- You have to accept that one day (hopefully far off into the future) that you just might die.

- …and yes, there is a legal cost associated with writing up a will and with estate planning.

“Trust in trusts.”

The second component of a smart estate plan is often a trust.

A trust is nothing more than a means of transferring property to a third party (i.e., the trust). Think of the trust as an entity – a person, per se – who never, ever dies.

Specifically, a trust lets you transfer title of your assets to trustees for the benefit of the people you want to take care of (aka: your selected beneficiaries). From there, upon your passing, the trustee(s) will carry out your wishes on behalf of your beneficiaries.

Wills vs. Trusts: “What makes the most sense for me?”

Broadly speaking, there are two types of trusts:

- Living Trusts (established while you are alive)

- Testamentary Trusts (which are created by your will after you’ve passed).

Living trusts are becoming more and more popular to avoid the cost of probate. In the probate process, your representatives “prove” the validity of your will. The probate process also gives any creditors the opportunity to collect their due before your estate is passed to your heirs.

Those who have “been there and done that” will tell you that there may be a long delay in settling your estate as it goes through probate. In fact, the larger the estate, the longer the probate process in most cases. Then, if that wasn’t bad enough, adding salt to the wound, probate can be costly as well.

A living trust can avoid or mitigate the effects of probate. It is a revocable trust that you establish and of which you are also typically the sole trustee (i.e., you’re in charge!).

Once established and funded, the assets in your living trust avoid probate at death, and are instead distributed to your heirs according to your wishes.

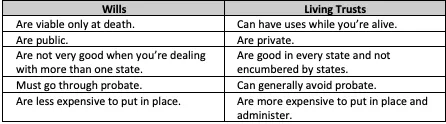

Living trusts are sometimes said to be superior to a will, but that is certainly not the case for everyone, so it’s important that you understand how they compare.

Is a trust for you?

- Are your beneficiaries unwilling or unable to handle the responsibilities of an outright gift (investing the assets, spending the gift wisely, etc.)?

- Do you want to keep the amount and the ways your assets are distributed to heirs a secret?

- Do you want to delay or restrict the ownership of the assets by the beneficiary?

- Do you need to provide protection from your and/or your beneficiary’s creditors and plaintiffs?

- Do you have a disabled child (including adult children)?

- Do you have irresponsible children that you worry would not be mature enough to handle the gravity of receiving a lump-sum check for their portion of the inheritance?

- Do you want to lower your estate taxes, if applicable?

If you answered “yes” to any of these seven questions, you may find it beneficial to set up a trust.

Comparing Wills and Living Trusts:

What’s your next move?

We recommend that your estate plan be reviewed at least every 3-5 years. The review should be conducted by a high-caliber wealth manager, qualified estate planning attorney, or tax professional.

Furthermore, whoever reviews your estate planning documents must be someone who takes the time to learn what’s changed since you put your original solutions in place, assess how those changes might impact your strategy going forward, and make recommendations for getting your solutions current and in accordance with your wishes and/or changes in tax laws.

Bottom line, it’s crucial to build the right strategy – one that’s customized for YOU!

If you’d like a 2nd opinion on your estate plan (which would include your will, trust, powers of attorney, and more), as well as your retirement plan and investment portfolio, please feel free to reach out to us and set up an introduction call.

Think of it as – hmmm… maybe part of your “New Year’s Resolution!”

‘till next time!

Adam